What is the Hard Seltzer Market Size?

The global hard seltzer market size is calculated at USD 21.89 billion in 2025 and is predicted to increase from USD 25.17 billion in 2026 to approximately USD 83.41 billion by 2035, expanding at a CAGR of 14.31% from 2026 to 2035.

Hard Seltzer Market Key Takeaways

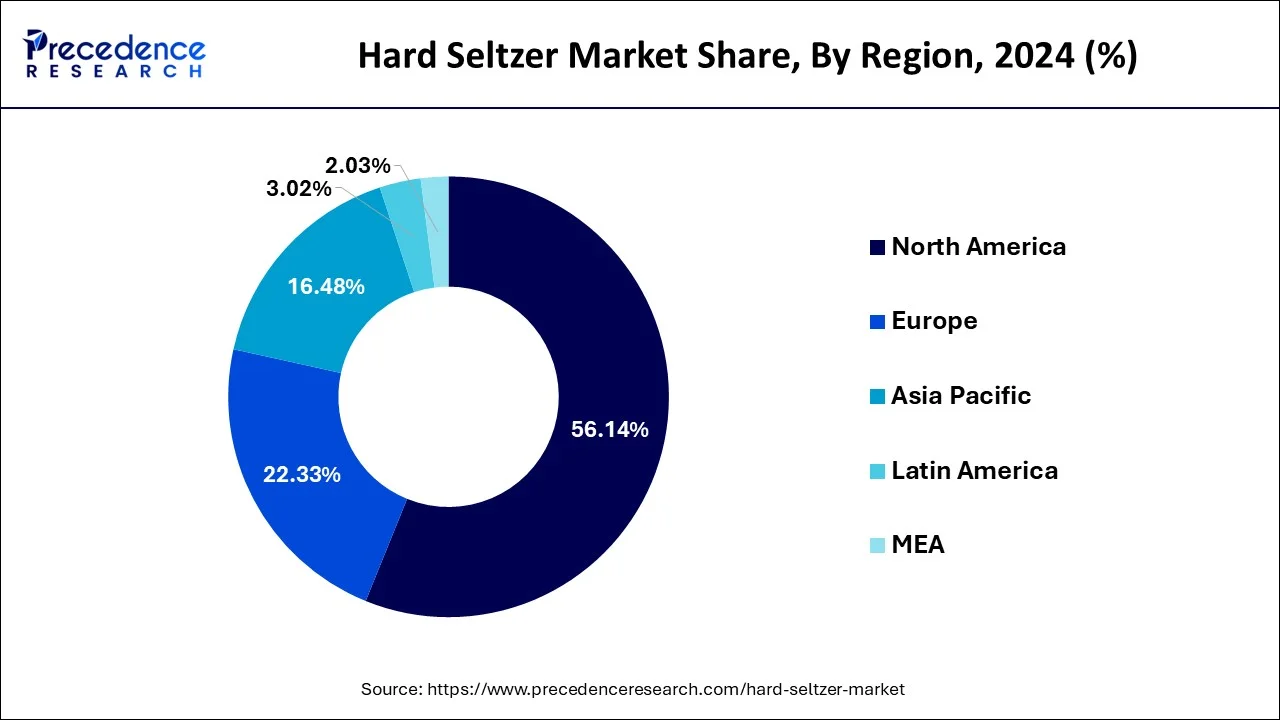

- North America dominated the global market with the largest market share of 56.14% in 2025.

- Europe market is anticipated to grow the fastest CAGR from 2026 to 2035.

- By ABV content, the 5.0% to 6.9% segment generated more than 52% of the revenue share in 2025.

- By ABV content, the 1.0% to 4.9% segment is anticipated to grow approximately at a 24% CAGR between 2026 and 2035.

- By distribution channel, the off-trade segment contributed approximately 71% of revenue share in 2025.

- By distribution channel, the on-trade segment is predicted to grow at the fastest rate of approximately 24.10% between 2026 and 2035.

Market Overview

The demand for the product is driven by the younger generation's growing preference for low-alcohol beverages. Furthermore, the low-alcoholic drinks requirement has increased as consumers attempt to decrease their alcohol intake or become sober-curious.

Furthermore, due to stay-at-home orders from around the world, the revenue share of products increased drastically over e-commerce networks throughout the pandemic. Furthermore, hard seltzers meet the demand for new flavors and cocktail combinations, and insta-friendly sustainable cans provide easy installation.

Integration of AI in Hard Seltzer

Artificial intelligence (AI) is being used by beverage alcohol brand owners as a research tool and to help develop new products, but the technology also has the ability to improve other aspects of business operations, like as manufacturing efficiency and revenue management. Personalized product recommendations and taste profiling are two of the most important ways AI is changing the alcohol sector. AI plays a critical role in supply chain and operations management to improve sustainability and efficiency.

Hard Seltzer Market Growth Factors

- Growing demand for more options: Those who drink hard seltzer are searching for additional choices. This need for cutting-edge goods is directly driving the emergence of new drink varieties like hop waters and CBD-infused beverages. This need for additional options has also been influenced by growing manufacturer competitiveness and social media exposure to a greater variety of items.

- Shift towards healthier options: In the hard seltzer market, there is a greater need for low-calorie, gluten-free, and organic components as a result of the emphasis on health and wellbeing.

- Social media marketing and brand collaboration: In the hard seltzer sector, collaborations with celebrities and important businesses have been booming. Businesses are producing distinctive and special goods that are likely to be embraced as genuine by an existing customer base by utilizing the ingenuity and natural market penetration of social media celebrities and internet brands.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 21.89Billion |

| Market Size in 2026 | USD 25.17 Billion |

| Market Size by 2035 | USD 83.41Billion |

| Growth Rate from 2026 to 2035 | CAGR of 14.31% |

| Base Year | 2025 |

| Largest Market | North America |

| Forecast Period | 2026 to 2035 |

| Segments Covered | ABV Content, Packaging, Distribution Channel, Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Surge in urbanization

The market expanded significantly due to emerging economic growth, the tourism and travel industry, increased online liquor sales, and cafe and bar outlets. The growing influence of modernization on individuals, changing buyer perceptions of alcoholic beverage consumption, rapidly growing urbanization, and altering consumer preferences in emerging regions is predicted to drive the development of the global seltzer industry.

The rising trend of alcoholic beverage consumption among the young generation owing to changing user choices, rising disposable income, and consumer peer influence are the essential components expected to propel the demand for the global alcoholic beverage segment.

Restraints

Adverse health effects, as well as alcohol poisoning

Hard seltzer misuse occurs when a female consumes more than 12 ounces of hard seltzer per day or a male consumes more than 24 ounces of hard seltzer in a day, according to National Institute on Alcohol Abuse and Alcoholism (NIAAA). Hard seltzer abuse can progress to hard seltzer addiction over time. Even if one wants to, this disorder makes them unable to quit drinking seltzer. Tolerance and physical dependence are also signs of addiction to hard seltzer. Tolerance means more extensive or frequent drinks to achieve the desired effect.

Physical dependence occurs when the body requires hard seltzer to function. For instance, Conigliaro warned that binge drinking makes people more likely to engage in risky sexual behavior, get into fights, or drive while intoxicated. Additionally, they run a higher risk of developing alcohol poisoning, a severe and possibly fatal side effect of consuming too much alcohol quickly.

Opportunities

Rising adoption of new flavors among consumers

The flavor profiles vary by brand and range from primary flavors like black cherry, lime, and ruby grapefruit to much more elevated flavors like melon basil, lemon agave hibiscus, and cucumber peach. As a result of changes in consumer preferences and the influence of peers among consumers, there is an increasing trend of alcohol consumption among the older and younger generations.

According to the National Family Health Survey-4 (NFHS-4), alcohol consumption is widespread throughout India across all states and union territories (UT), with a projected 160 million people consuming alcohol, including 29.2 % of men and 1.2% of women. Since hard seltzer drinks have improved in taste and variety for health-conscious consumers, the global hard seltzer market has seen a considerable increase in sales and demand.

- In June 2024, in the UK, White Claw, a hard seltzer company, introduced two new summer tastes. With these new releases, the brand's signature hard seltzer now comes in 14 varieties, seven of which are accessible in the UK.

Segment Insights

ABV Content Insights

The global hard seltzer industry is segmented on ABV content into 1.0% to 4.9%, 5.0% to 6.9%, and others. 5.0% to 6.9% ABV hard seltzers accounted for over 52% of the revenues generated in 2024. The concept of moderation is a rising trend, particularly in the US, driving this segment's growth. Many alcohol industry players have been developing their product lines of low-alcohol drinks.

1.0% to 4.9% ABV hard seltzer sales are anticipated to grow approximately at a 24% CAGR between 2025 and 2034. Due to the rise in awareness regarding general well-being, individuals of all age groups are attempting to reduce alcohol consumption. A significant boost in online forums about minimizing drinking over the last two years and a notable reduction in discussions about casual and high drinking events have been implemented. San Juan Spiked, Funky Buddha Premium, Corona, BON Viv Spiked, Crook & Marker Spiked Seltzer, Smirnoff, Night Shift Hoot, Willie's Superbrew, Coors Hard Seltzer are some of the key players in the market space.

Packaging Insights

The market is divided into two categories: metal cans and bottles. Cans made of metal have a larger market share as they have many benefits, like durability, printing of multi-color, convenience, and sustainability. Additionally, beverages in metal cans do not need additives and maintain their original taste for a prolonged period.

The canned form of hard seltzer with striking design and color enhances the premium look and appeal of the product; due to this, companies are focusing on introducing the product in the given format.

Since bottles provide a better handling and user experience than cans, the bottle segment is estimated to dominate the market during the predicted period. The primary factor in consumers' high preference for bottles is their transparency, allowing the inside substance to be displayed.

Distribution Channel Insights

The market is segmented into on-trade and off-trade distribution channels. The off-trade segment was the highest distribution channel, accounting for approximately 71% of revenue in 2025. All retail stores, for instance, convenience stores, supermarkets, wine and spirit shops, and mini markets, are included in this segment. People often prefer these shops because they provide substantial discounts and promotions.

Furthermore, most brands introduce their goods through big supermarket chains, including Target and Walmart, to achieve a broader consumer base. Rising urbanization and rapid retail sector growth are anticipated to propel the off-trade channel of the hard seltzer market.

The on-trade channel is projected to grow at the fastest rate of approximately 24.10% from 2025 to 2034. Outlets which include bars, hotels, clubs, and lounges, are examples of on-trade distribution channels. However, product sales through on-trade channels increase with relaxed rules and individuals focusing on get-togethers, socializing, and parties.

Regional Insights

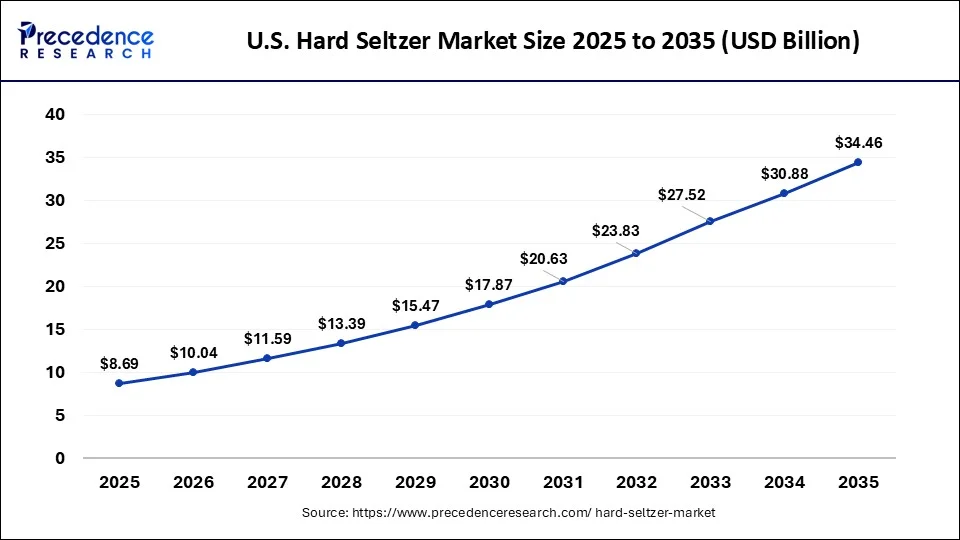

U.S. Hard Seltzer Market Size and Growth 2026 to 2035

The U.S. hard seltzer market size was estimated at USD 8.89 billion in 2025 and is predicted to be worth around USD 34.46 billion by 2035, at a CAGR of 14.77% from 2026 to 2035.

North America had the highest share of approximately 56.14% in 2025. The region noticed an increased demand, particularly from youth. Key players are encouraging the products they produce with novel techniques. Furthermore, the demand for these drinks made them appropriate to consumers, which is anticipated to increase hard seltzer consumption during the forecast period.

79.1% of those aged 12 and older, or 224.3 million individuals, reported drinking alcohol at some point in their lives, according to the 2023 National Survey on Drug Use and Health (NSDUH). Twenty-six percent of the children aged 12 to 17 (5.6 million) said they had consumed alcohol at some time in their lives. The control and sale of alcohol generated $15.5 billion (+2.5%) for the federal and provincial governments ($13.6 billion, +0.1%) in the fiscal year that ended in March 2023. Alcoholic drinks were sold for a total of $26.3 billion by liquor authorities and other retail establishments.

Why is the Market in Europe Growing at the Fastest Rate?

The European hard seltzer industry is anticipated to grow fastest CAGR In the next few years, lifestyle changes and consumer preferences are expected to fuel the expansion of the seltzer market. The demand for the seltzer industry is propelled as people become health-conscious and enhance their consumption of carbonated beverages. Seltzer is low in calories, gluten-free, and high in nutritional value. Seltzers are provided with alternative alcohol bases to meet various consumer needs.

The growing demand for low-alcohol and low-calorie beverages is driving up demand for seltzer in Europe, as it contains fewer carbohydrates and calories than other beers and mixed drinks.

The estimated amount of Alcohol Duty revenues in the UK from August to October 2025 is £3,060 million, or £181 million (6%). Alcohol Duty revenues from wine and other fermented goods are estimated to reach £1,153 million, or £83 million, during August and October of 2025.

What Makes Asia Pacific a Significantly Growing Area?

Asia Pacific is expected to grow at a significant rate throughout the forecast period. This growth is attributed to various factors such as urbanization, rising disposable incomes, and the high consumption of ready-to-drink beverages. Hard seltzer is gaining traction among young consumers in countries such as Japan, China, and India, where awareness about low-calorie alcohol alternatives is increasing.

Localized flavors that are inspired by regional fruits and spices help to foster innovation as well as create a strong consumer appeal. E-commerce expansion and partnerships with local distributors also help to enhance product reach and awareness. The region is also witnessing growing investments between international and regional players, which is likely to propel the market even further.

How is the Opportunistic Rise of Latin America in the Hard Seltzer Market?

Latin America is expected to experience an opportunistic rise in the market over the forecasted years. This is mainly due to rapid urbanization, a rising middle class with higher disposable incomes, and a growing health-conscious demographic that is seeking lower-calorie, gluten-free, and low-sugar alcoholic beverages. The appeal of hard seltzers as a refreshing, convenient, and low-calorie alternative compared to traditional spirits and beers is a trend that is observed among Millennials and Gen Z consumers, who are seen prioritizing wellness and lifestyle-oriented products. Major beverage companies and craft breweries in the region are launching a variety of flavored hard seltzer products tailored to regional tastes, thus boosting innovation and market potential.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) presents significant opportunities in the hard seltzer market, driven by the region's growing urbanization and shifting preferences toward premium and functional beverages. The region benefits from a youthful demographic, which leads to the increasing adoption of Western lifestyles. Moreover, the region's expanding hospitality sector presents various opportunities for brand differentiation and innovation, thereby leading to gradual market growth.

Value Chain Analysis

- Raw Material Sourcing

Hard seltzer typically requires a simple sugar base, resulting in a cleaner fermentation profile necessary for the signature neutral taste.

Key Players: ADM, Kerry Group, Cargill - Manufacturing Process

This stage deals with the fermentation, filtration, and clarification of the base.

Key Players: Vizzy, White Claw, Bud Light Seltzer - Distribution Process

In this stage, the seltzer is packaged and then distributed through various lines. Most seltzers are packaged in sleek, slim aluminum cans, requiring specialized canning equipment.

Key Players: Molson Coors, Heineken, Boston Beer Company

Hard Seltzer Market Companies

- The Coca-Cola Company

- Mark Anthony Brands International

- Heineken N.V.

- Anheuser-Busch InBev

- Diageo plc

- Kopparberg

- The Boston Beer Company

- Constellation Brands, Inc.

- Molson Coors Beverage Company

- San Juan Seltzer, Inc.

Latest Announcements by Industry Leaders

‘We regard Spyk as a market leader and disruptor in the hard seltzer category,' says Vamsi Krishna, CMO and co-founder of Spyk Hard Seltzer. Further he added, ‘our goal is to reinvent social drinking by creating a beverage that suits everyone's lifestyle preferences and is associated with people who work and play hard. We at Spyk are sure that we can emerge as the thrilling substitute to combat the heat.

Recent Developments

- In March 2025, Carlsberg Group signed a multi-year partnership with UEFA to become the Official Beer of UEFA National Team Football. The deal with the Danish brewer includes UEFA EURO 2028, UEFA Women's EURO 2029, the UEFA Nations League Finals, the UEFA Women's Nations League, and the Men's and Women's European Qualifiers. The partnership represents a continuation of the business's long-standing commitment to the world of sport.

(Source: https://www.uefa.com - In July 2025, The Coca-Cola Company announced the launch of a new version of its signature beverage made with U.S. cane sugar, scheduled for release in the U.S. later in the fall.(Source: https://www.bing.com )

- In August 2024, the world's first session hard seltzer, Dirty Water, announces an interesting collaboration with Throwing Fits's James Harris and Lawrence.

- Schlossman. The partnership seeks to introduce this innovative new alcoholic beverage to the New York City scene and beyond.

- In July 2024, the eyewear company and AB InBev-owned vodka seltzer Nütrl collaborated to introduce three new fruit-colored sunglasses that go well with three of the company's distinctive flavors.

Segments Covered in the Report

By ABV Content

- 1.0% to 4.9%

- 5.0% to 6.9%

- Others

By Packaging

- Metal Cans

- Bottle

By Distribution Channel

- Off-trade

- On-trade

ByGeography

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content